UK's Banking Sector on Alert for Potential Car Loan Misselling Scandal with Billions at Stake

The UK's banking sector is potentially facing a new financial dilemma reminiscent of past mis-selling scandals, this time involving car loans. According to estimates by the Royal Bank of Canada (RBC), the banking industry might face a bill of up to £10 billion. This situation arises from the Financial Conduct Authority's (FCA) investigation into auto lending practices, particularly focusing on the transparency of commission payments in dealership deals.

For decades, major lenders like Barclays Plc, Lloyds Banking Group Plc, and Banco Santander SA's UK arm have profited from funding car purchases. The FCA's current probe is centered on whether customers were adequately informed about the commissions paid to dealerships. This scrutiny follows a series of orders issued by the regulator for Section 166 reviews, which involve bringing in external experts to examine and report on a firm's practices.

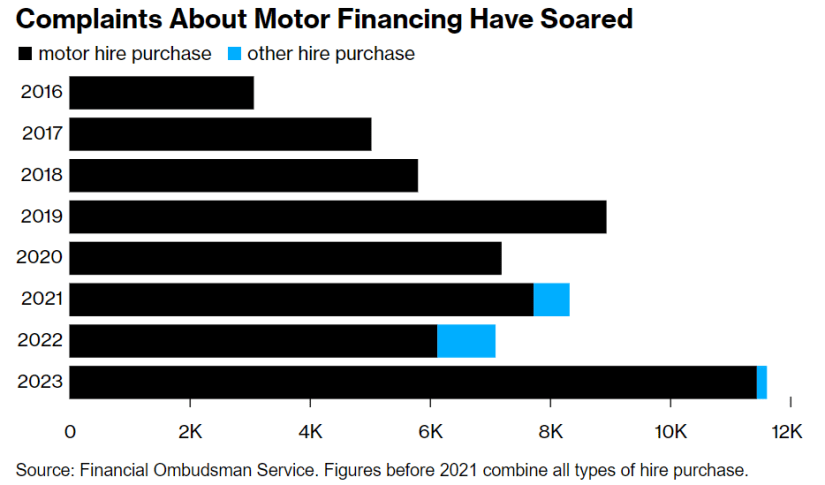

The practice in question, known as the "overage," allows dealers to earn extra by increasing the interest rate on a car loan, often without the consumer's knowledge. The Financial Ombudsman Service, handling customer complaints, has already led to some refunds following test cases.

This situation has already impacted the market, with shares in several banks, including Close Brothers Group Plc, experiencing significant drops. The FCA has put a temporary hold on new complaints while it finalizes its approach to resolving the issue.

The concern over car finance practices is not new. The FCA had previously raised alarms about the increasing use of personal contract purchases in car sales, and three years ago, it banned commissions that incentivized higher borrowing costs for customers.

Lloyds Banking Group, the largest provider of auto finance in the UK, is reviewing the Financial Ombudsman Service's decision and preparing for the FCA's review. Barclays, no longer offering car financing since 2019, is working to resolve historic complaints related to these loans. Santander UK has expressed its support for the FCA's intervention, seeking clarity for both customers and finance firms.

The situation has drawn comparisons to the payment protection insurance (PPI) mis-selling scandal, which cost the banking industry over £38 billion in compensation. Martin Lewis, a well-known consumer rights activist, highlighted the potential scale of compensation, which could involve interest on loans, commissions, or even the entire loan amount.

Analysts from RBC have described the potential impact on the banking sector as significant, while others have criticized these predictions. Nevertheless, this unfolding situation underscores the need for more transparent and fair financial practices in the UK's banking and auto finance sectors.

Notes to the editor

For further information please contact:

Sonia Mattis or Kevin Stewart at news@carsvansandbikes.com

Keep up-to-date with CarsVansandBikes.com on Twitter; @Carsvansbikes

or follow us on Linkedin: www.linkedin.com/company/carsvansandbikes

Revolutionizing Vehicle Search with Fairness and Transparency

The digital quest for the perfect vehicle—be it a car, van, or motorbike—has been transformed by CarsVansandBikes.com. Launched in 2021, this digital advertising platform has rapidly become a go-to destination for motorists seeking new or pre-owned vehicles. True to its ethos, "As easy as CVB," the platform simplifies the search process, making it more accessible and user-friendly.

What sets CarsVansandBikes.com apart is its foundational commitment to unbiased advertising. Unlike other platforms where sponsored listings skew visibility, CVB presents all vehicles without undue influence. This principled stance guarantees a transparent and fair experience, ensuring users find the right vehicle based on its merits, not its marketing budget.

Our commitment to the community is clear and steadfast: for personal consumers and private motorists, advertising on CarsVansandBikes.com is, and will always be, completely free. This initiative breaks down financial barriers and empowers individuals to sell their vehicles directly to a wide audience.

To build a sustainable, high-quality marketplace featuring both private and professional sellers, we now charge a fee to motor dealers. This balanced approach ensures we can continue to invest in and improve the platform for everyone, while honouring our original promise to our private user community.

By fostering direct connections between sellers and buyers and providing deep, detailed vehicle information, CarsVansandBikes.com goes beyond a transactional relationship. It creates an informed community where everyone is equipped to make the best possible choice.

As CarsVansandBikes.com continues to grow, its impact is undeniable. With its user-friendly interface, unwavering commitment to unbiased listings, and innovative model that keeps the platform free for private sellers, CVB represents a paradigm shift in how we find and advertise vehicles.